Serious people often try to draw lessons from the quest for better therapeutics or health technology for research more generally. From how to fund and commercialize technologies to the value of patents to self-sustaining institutional structures.

This is a mistake! It’s easy to forget, but technology aiming to improve human health has a laundry list of different characteristics that make it an entirely different beast from other technologies.

Some throat clearing: I’m going to play a bit fast and loose with the terms “health technology,” “therapeutics,” and “drugs.” There are obvious exceptions, but for the most part, drugs are a category of therapeutics, which are a category of health technology. The characteristics differentiating them from other technologies apply most strongly to drugs with more exceptions as you move to broader categories.

Health Technology is uniquely appealing

Health technology is one of the most direct and obvious ways for technology to help people.

Ideally, it takes someone who has a clear, potentially life-ending problem, and makes that problem go away. Everybody has some first-hand experience with the ravages of illness, so everybody understands the problems that health technology is solving and why they are important. Assuming you think more people living longer, healthier lives is a good thing, health technology is close to an unmitigated good.

By contrast, most other technologies are not unmitigated goods — they can have negative externalities, unintended consequences, and bad actors can use them to actively commit harm. Furthermore, most technology helps people through second-order effects. This indirection between technology and its impact on life quality makes it harder to justify on altruistic grounds and drastically increases uncertainty over whether its success is worthwhile.

Supporting health technology is not just altruism: all things being equal, most of us want longer, healthier lives for ourselves and the people we care about.

All of this means that on the margin, it is much more satisfying and justifiable to work on or financially support health technology.

Therapeutics create tight correspondence between scientific discoveries, patents, and products

In a gross simplification, the process of creating a drug consists of identifying a molecule that has a biological effect, patenting that molecule/effect combination, going through FDA trials to show safety and efficacy in humans, and then packaging up that molecule in a pill/solution and selling it. This process still requires an immense amount of time, effort, and money.

There is a near 1-1-1 correspondence between a therapeutic product, a specific patent, and a lab discovery that was the basis for that patent. This correspondence means you rarely need to build a system that might require research on other functional components or bringing in patented technologies to turn the discovery into a product.

This property is unusual for many reasons! Most other technologies need a lot more research to turn a discovery about nature into a useful technology. Take carbon fiber or passenger airplanes as two examples:

Carbon fiber is more representative of typical technology trajectories, with a decades-long, research-filled gap between the discovery that carbon fibers have high tensile strength and the creation of useful carbon fiber composites. Those composites then needed to combine with many other components (that may or may not be patented!) to create an actual product. People don’t want a pile of carbon fiber and epoxy — they want a super-light bike or airplane.

Passenger airplanes were arguably enabled by the Wright Brothers’ discovery that (and subsequent patent on) the way to steer an airplane was by changing the shape of its wings. However, a functional passenger plane requires far more than a control mechanism: engines, propellers, an airframe, landing gear, and more (not to mention the non-airplane infrastructure for maintenance, refueling, airstrips, etc.). Arguably, vigorous enforcement of the Wright’s patents (and others) held back the airplane industry in the early 20th century.

The downstream effects of therapeutics’ tight correspondence between discovery, patent, and product is that in the world of therapeutics:

1. Academic research, which is particularly good at discoveries, is directly connected to products.

2. The lines around patent infringement are reasonably clear.

3. Because there’s a close correspondence between patent and product, patents get in the way of innovation relatively infrequently (Their effect on drug prices is another issue.)

4. Because of #2 and #3, patents actually serve the purpose they were intended to and incentivize work by enabling an inventor to capture the value of their work.

5. Because of #4, it’s common and straightforward for the discoverer of a drug to become wealthy off of its sales.

None of these are the case for most other technologies:

1. Most technologies need tons of non-academic research after the initial discovery to even create a useful technology.

2. The lines around patent infringement are fuzzy because the ultimate products are a system made of many different components.

3. As a result of #1 and #2, it’s much harder for researchers who created the initial discovery to capture the value that they create.

4. As a result of #2 and #3, patents correspond only weakly with impactful new products, don’t serve the purposes they were intended for, and often get in the way of innovation. Remember, patents inherently prevent a piece of IP from being combined with other knowledge. (For example, the wright patent was on how to steer a plane and Arguably patents held back the airplane industry because nobody could innovate on other parts of the plane because of wright’s monopoly on a key component).

There is a well-trod pathway from lab to market for healthtec innovations

The three-phase Food and Drug Administration (FDA) approval process creates clear milestones on a health technology’s transition from lab to market. Those milestones provide new therapeutics with a relatively straightforward (but still risky!) path that enables a lab to chart a path all the way from benchtop discovery to IPO: “based on this interaction, we need $X to get Phase 1 approval, $Y to get Phase 2 approval, and then we will IPO or get acquired because we know that if we get FDA approval, we’ll make $N in revenue.”

That level of clarity from day one is a complete pipedream for most technologies that are still in a lab, especially those whose success depends on creating a new market.

The legibility of a therapeutic’s path from lab to market drastically reduces uncertainty for investors, which in turn funnels more money towards development. Clear milestones make it straightforward for therapeutics companies to set up investment tranches with VCs and large drug companies that unlock known quantities of money when they hit approval-based milestones.

An additional benefit is that the rough amounts of money it takes to get from one phase to the next is a known quantity. Negotiating that sort of tranching for other technologies is incredibly hard: not only is it hard to know a-priori how much money it will to take to get to the next milestone, it’s hard to negotiate what the milestones would even be, leading to a “I’ll know it when I see it” attitude from investors.

There is so much clarity that many large drug companies have incorporated research-heavy therapeutics startups into their business models: to a large extent, big drug companies are giant sales and manufacturing organizations that depend on acquiring startups to create new business lines. This relationship between startups and large companies is completely different in other industries where incumbents’ reactions to new technologies often range from confusion to hostility.

FDA approval has effects far beyond the United States: many countries use FDA approval to expedite their own regulatory process.

The market for health technology has unique dynamics

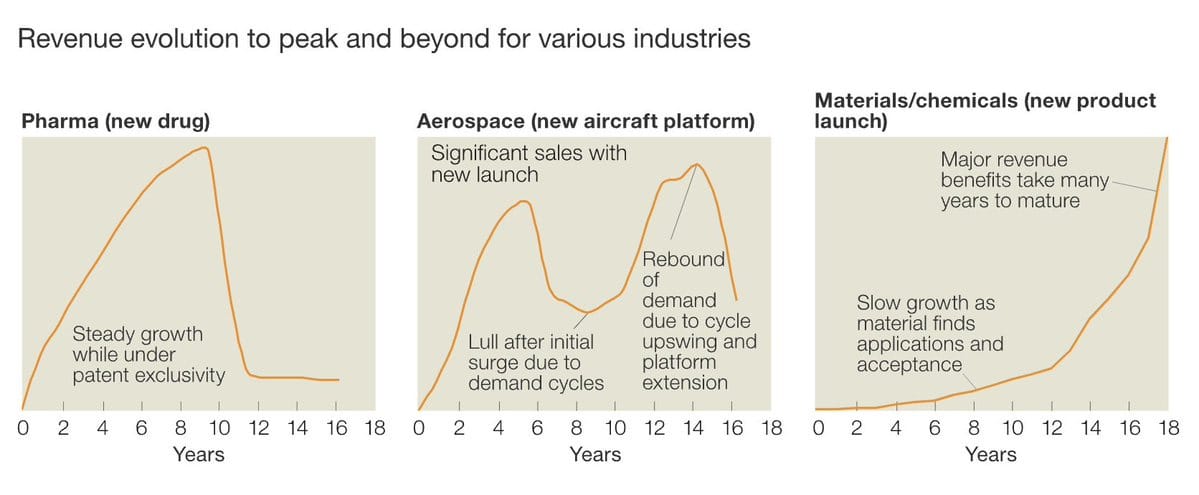

The market for health technology (excluding preventative technology and diagnostics) looks very different from markets for other new technologies. In many situations, as long as a new intervention is marginally more effective, it can rapidly command massive prices and high margins. Most other (non-software) technologies need to be significantly better than the existing options to even be adopted. That adoption is often slow, even for a drastically superior technology, because it requires overhauling infrastructure or processes and there are often people whose careers were based around previous paradigms. Even once a technology is adopted, most margins outside of software are far lower than therapeutics.

The reasons for these differences are downstream from both intrinsic properties of health technology (especially drugs) and legal dynamics around the healthcare industry.

High margins on health technologies are also a result of strong disconnect between the patients who ultimately use them, the organizations paying for them (primarily employers or the government), and the organizations setting prices (some combination of hospitals, drug companies, and insurance companies). This system is incredibly complex and understanding all its dynamics requires expertise far beyond my own, but the result is that health technology can command prices far above more straightforward technology markets.

These dynamics mean that therapeutics have much less market risk than most other high-margin technologies.

Most high-margin technologies are not incremental changes. As a result, they rarely slot easily into existing systems, requiring adopters to overhaul processes, build new skills, think in new ways, and potentially swap out a significant amount of capital. Most frontier technology requires inventing an entirely new sales channel. Often, it’s not even clear how to best use a non-incremental new technology. All of these barriers mean that most high-margin technologies have significant market risk.

Therapeutics are high margin, but avoid many of these market risks: legal mandates on insurers mean that incremental improvements can still command high margins. Using new drugs rarely threatens a career. There is an established playbook by which new companies can partner with large drug companies who have sales channels to insurers and doctors. All of these dynamics mean that therapeutics have much less market risk than most high-margin technologies.

Established sales channels and low market risk means that drugs are adopted far more quickly than other non-software technologies. This quick adoption, combined with relatively fast liquidity events (therapeutics companies regularly IPO while still doing R&D before they even have a product) means that therapeutics often make far better VC investments than other non-software technologies.